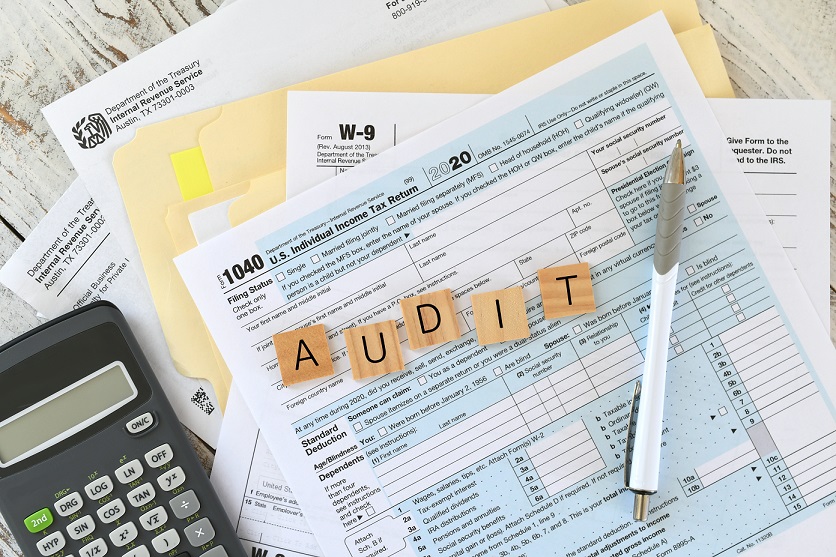

Few words strike as much fear in taxpayers as “IRS audit.” While the thought of being audited can be intimidating, the reality is that audits are a normal part of the tax system. With the right knowledge and preparation, you can protect yourself, reduce stress, and handle the process with confidence.

This article explains what an IRS audit is, why it happens, and what steps you can take to protect yourself throughout the process. Remember, this content is for educational purposes only. If you are selected for an audit, always seek the advice of a qualified tax professional.

What Is an IRS Audit?

An audit is the IRS’s way of reviewing your tax return to ensure the information you reported is accurate. It doesn’t always mean you did something wrong sometimes returns are selected randomly, while other times they’re flagged by IRS systems for unusual activity.

Common reasons for audits include:

- Large or unusual deductions compared to reported income.

- Failure to report all income from employers, clients, or banks.

- Home office deductions that appear inconsistent.

- Self-employment returns with high expense claims.

- Mathematical errors or missing forms.

Types of IRS Audits

- Correspondence Audit: Conducted by mail, usually requesting additional documents.

- Office Audit: You visit an IRS office with records for review.

- Field Audit: An IRS agent visits your home or business to examine records in person.

Steps to Protect Yourself

If you receive an audit notice, here are important steps to follow:

- Read the Notice Carefully: The letter will explain what year and which items are being questioned.

- Stay Organized: Collect receipts, invoices, and documentation that support your return.

- Respond on Time: Missing deadlines can escalate penalties or cause the IRS to make decisions without your input.

- Be Honest: Never create or falsify documents. Accuracy and transparency are key.

- Get Representation: A CPA, tax attorney, or enrolled agent can communicate with the IRS on your behalf.

Tip to Remember

Educational NoteThe IRS cannot ask for more than what’s stated in the audit notice. Focus only on the tax years and issues listed. Providing extra, unrelated information may open new questions unnecessarily.

How to Lower Your Chances of an Audit

While no one can eliminate the possibility of an audit, there are ways to reduce the risk:

- Report all income accurately, including side jobs and investment earnings.

- Only claim legitimate deductions with documentation to back them up.

- Double-check calculations before filing.

- File electronically to reduce clerical errors.

- Work with a professional tax preparer for complex returns.

What Happens If You Owe More Taxes?

If the audit shows that you owe additional taxes, the IRS will send a notice explaining the balance due. You may:

- Pay the amount in full.

- Request a payment plan through an installment agreement.

- Dispute the findings by filing an appeal.

In some cases, penalties or interest may be added. This is why providing strong documentation is critical.

Your Rights During an Audit

Many taxpayers don’t realize they have rights during the audit process, including:

- The right to professional and courteous treatment from IRS staff.

- The right to privacy and confidentiality of your tax information.

- The right to representation by a qualified tax professional.

- The right to appeal IRS decisions in court if you disagree.

Final Thoughts

An IRS audit may feel intimidating, but it doesn’t have to be overwhelming. With preparation, organization, and the right guidance, you can protect yourself and ensure a fair review. Remember, being selected for an audit is not an automatic accusation of wrongdoing it’s a verification process. Your best defense is accurate records and professional support.

Disclaimer: This article is for informational purposes only. Tax Doctors of America is not affiliated with the IRS or any government agency. Always consult a qualified tax professional for personal audit representation.